Degen Insider Is Brought To You By Menace.com Crypto Sportsbook & Casino

Sup fellow degens,

Michael Saylor, the champion of Capua, never backs down.

Swing your sword, and let the charts shed blood. And you will still find him standing in the middle of the Colosseum, hands outstretched as if reaching for the gods, with the arena reverberating and the crowd roaring his name.

Saylor! Saylor! Saylor!

The last few weeks have seen a terrified market. You can feel it in the pulse of the timeline. Bitcoin dipped below $90k yesterday, and the “it's over" and “it-was-a-scam” crowd came out in full force. Talks about a failed “Uptober," tariffs, and the Fed.

Retail is panic-selling because they look at the 15-minute chart. On the other hand, the whales are buying because they look at the 10-year chart.

The biggest whale just stepped in to remind everyone who owns the sea.

Alpha Move: Saylor’s $835M Buy

Yesterday, while the rest of us mere gladiators were nursing our wounds, Spartacus said, “Never back down.” Time to hold the sword tighter.

Saylor, the Champion of Capua.

Michael Saylor's company, MicroStrategy ($MSTR), confirmed a fresh purchase of 8,178 Bitcoin.

Quick details:

Cost: $835.6 million

Average price: $102,200 per BTC (yes, he bought above current market price)

Total Holdings: about 331,200 BTC in the MicroStrategy coffers.

Total Invested: Over $16.5 billion in Bitcoin purchases since 2020.

Money Glitch

Saylor has effectively created an infinite money glitch, but the market hasn't priced just how insane this is.

Here's how the loop turned out to be:

MSTR stock trades at a premium to its Bitcoin holdings. Right now, the “NAV premium" is around 2.5x. That means for every $1 of Bitcoin MicroStrategy holds, the stock is valued at $2.50.

He issues stock to buy more Bitcoin. Saylor sells equity at inflated prices to Wall Street Investors who want Bitcoin exposure without actually holding Bitcoin.

The Bitcoin purchase increases the holdings. More BTC on the balance sheet=higher NAV.

The stock price goes up. Investors see the increased holdings and bid up $MSTR.

REPEAT. As long as the premium exists, Saylor can keep issuing stock and stacking sats at a discount to market price.

MicroStrategy continues to leverage Wall Street's appetite for Bitcoin exposure to accumulate BTC faster than almost any entity on Earth. They are the 4th largest holder of Bitcoin globally, behind only mysterious Satoshi, Binance, and BlackRock's ETF.

BTC Price at $90k, Saylor's Defence Line

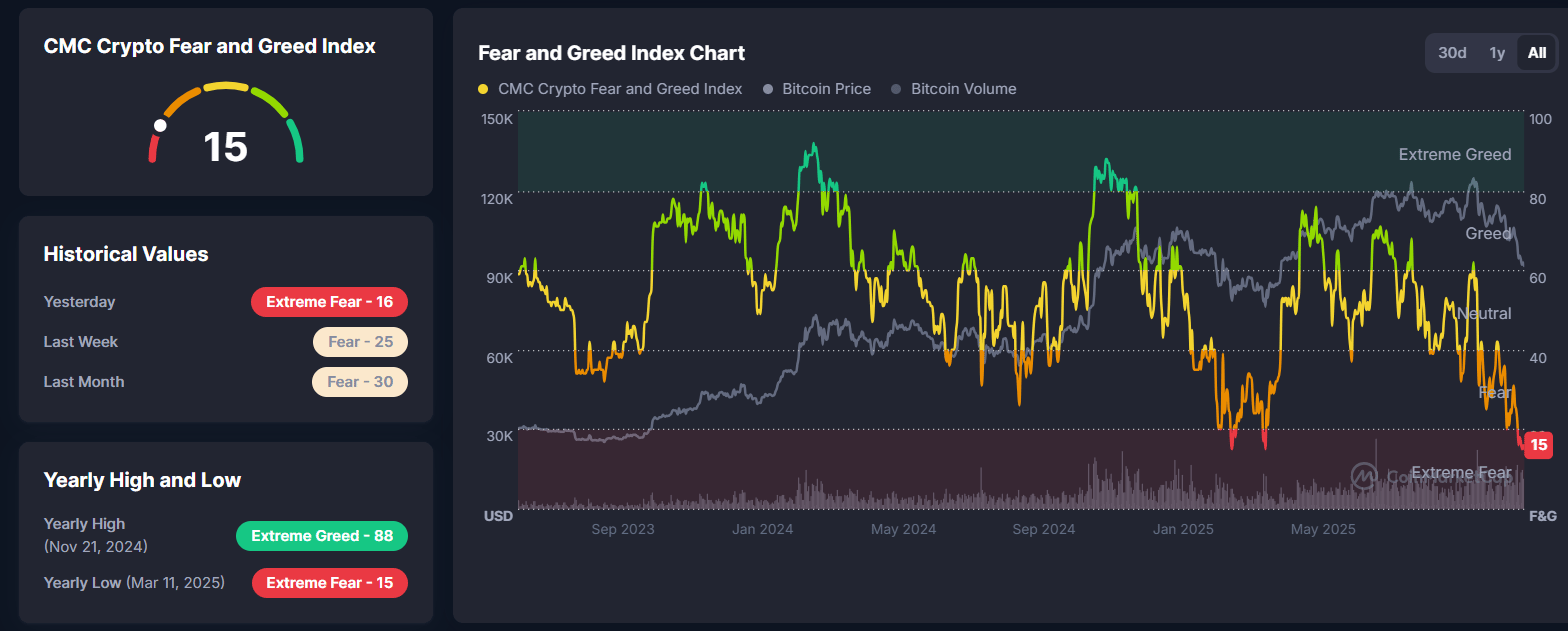

Bitcoin's fall to $90k hurt the market and sentiment has quickly turned to extreme fear.

Crypto market sentiment in extreme fear

But what most are missing is that our Spartacus is creating a massive battle at the $90,000 level in real-time.

Every time the price slumps down to $89k, it gets bought up aggressively. Now we know that a huge chunk of that buy pressure is Saylor. He's not just buying; he's the “S” in surge.

Look at the timing:

Bitcoin crashed to $89,500 on November 18.

Saylor announced an $835M buy on November 19.

Price immediately recovers to $91,000+.

Even though he bought at $102k and he's underwater, he doesn't care. He's not trading on a 3-day chart. He's building a position for the next decade. That conviction is a whale's game, and the market rewards patience.

The Bear Case?

Of course, the naysayers always have a point.

“Saylor is over-leveraged and one day this will blow up in his face.”

Valid point. The company has taken on debts to buy Bitcoin. If Bitcoin crashes, he may need to file a Chapter 7.

Hey, McDonald's always needs hands.

This thesis is wonky. For $MSTR to blow up, Bitcoin needs to drop 78% (about $20k) from current levels and stay there long enough for debt maturities to hit.

MicroStrategy’s average cost basis is around $49,874 per BTC. Bitcoin needs to go red below $50k and stay there long enough for margin to get called. Even when winter came for House Crypto in 2022, and Bitcoin hit $15k, Saylor didn't get margin called. He just kept buying.

“NAV premium will collapse"

Ok, let's say the premium goes to zero, Saylor can't issue stock efficiently. But the Bitcoin they hold still exists. At worst, the money printer slows down. At best, he keeps stacking while everyone doubts.

Betting against Bitcoin right now is betting that Michael Saylor will run out of paperwork to sell to Wall Street giants.

I wouldn't take that bet if I were you.

This is NOT Your Colosseum.

You're trading in the arena with giants.

While you're panic-selling your 0.01 BTC because your rent went up, this guy is buying $800M worth.

While you see fear on the 1-hour chart, institutional investors look at the 10-year chart and see inevitability.

The chop is temporary. The trend is your friend. As retail sells bottom, institutions stack sats.

Follow the giant.

TL;DR: MicroStrategy bought 8,178 BTC (~835.6M) on November 19. This is Saylor's strategy of defending the $90k level. Don't leverage, but the spot at the $90k-$92k zone. The vibe: corporate investors are entering the market fast, be early.

Stay degen,

Dima.

Who is Menace Dima?

Look, I could bore you with my "professional bio" – you know, the whole "20+ years in the gambling industry" spiel, the $100M+ portfolio, or how I've had my fingers in every gambling pie from affiliate marketing to running major operators.

But here's what you really need to know: I'm the guy who's probably lost (and won) more money than most, has the wildest degen stories you've never heard, and still can't resist a good bet. Whether it's dropping stacks on MMA fights, grinding poker until sunrise, or testing every new casino game that hits the market – I've done it all, and I'm still doing it.

These days, I'm repping Menace.com (yeah, that name goes hard) as their ambassador, but more importantly, I'm here to be your inside man. The guy who's seen the industry from every angle – from boardroom to bathroom floor – and lived to tell the tales.

Stick around if you want gambling content that isn't just another boring guy in a suit telling you about odds. This is about to get interesting.

Follow me elsewhere:

Instagram: https://www.instagram.com/menacedima